Why Medical Equipment Loan is Important for Medical Professionals

In recent years, there have been many breakthroughs in the healthcare industry, which has undoubtedly served the masses in a much more positive way than ever before. As a healthcare professional for over two decades, I planned to start my own clinic here in Gurugram, Haryana.

At first, I was of idea that my savings would be enough to set up the entire thing but believe me, once you initiate this process, money flows like water.

What is Medical Equipment Financing?

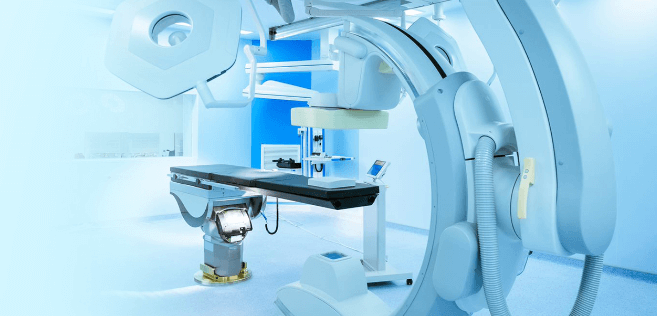

Every healthcare facility requires basic necessities in order to provide state-of-the-art treatment to all the patients. Now, it is well-known that the cost of such equipment can start from a few thousand and can easily go up to a few lakhs.

This is where this type of financing steps in. It basically refers to the process of obtaining funding or loans specifically to acquire medical equipment for healthcare facilities. This financial solution allows healthcare providers to acquire necessary medical equipment without paying the full cost upfront.

It is well-known that this equipment can be pretty expensive, and the facilities may not always have sufficient funds to purchase it outright. This financing provides a means to overcome any financial hurdle by offering various financing options, such as loans, leases, or even equipment rental agreements.

Why is it important for Medical Professionals?

● Access to modern technology

In the healthcare sphere, medical advancements and innovations are taking place with each day passing by. So, by medical equipment financing in India, medical professionals can easily access the latest technology, which will ultimately allow them to provide better patient care and enhance outcomes.

● Cost Management

The equipment related to the medical field can undoubtedly be prohibitively expensive, especially for smaller healthcare practices or individual practitioners. These financing options provide a way to manage costs by spreading them out over time. So, instead of making a large upfront payment, professionals can budget for regular installment payments that align with their cash flow.

● Enhanced Patient Care

Access to advanced equipment can significantly improve patient care. It can lead to faster and more accurate diagnoses, less invasive procedures, reduced recovery times, and improved outcomes.

● Competitive Advantage

Having state-of-the-art and top-notch technology in the facility gives healthcare providers a competitive edge. This allows them to offer advanced procedures and treatments, attract more patients, and position themselves as the leaders of the industry.

What are the criteria for medical equipment financing in India?

The criteria for this can totally vary depending on the financial institution you choose. However, here are some common factors that lenders may consider when evaluating applications:

1. Creditworthiness

The Creditworthiness of the borrower includes credit history, financial stability, and repayment capacity. This is assessed by the lender before giving approval.

2. Business Profile

If the financing is sought by a healthcare facility, the profile of the organization is evaluated. This includes certain factors such as the number of years in operation, revenue, profitability, etc.

3. Loan Amount

The desired amount by the potential borrower will be taken into consideration as well. Therefore, they need to check on their part whether the amount asked is reasonable based on the borrower’s financial situation and repayment capacity.

Along with this, equipment details, down payment, financial documentation, and a business plan are also included in the criteria. If you are looking for medical equipment financing in India, Bajaj Finserv is one of the best platforms for the same. Highly recommended!